All Categories

Featured

Table of Contents

Getting rid of agent payment on indexed annuities allows for significantly greater illustrated and real cap rates (though still significantly lower than the cap prices for IUL plans), and no question a no-commission IUL plan would certainly press detailed and actual cap rates greater. As an aside, it is still feasible to have an agreement that is really rich in agent settlement have high early money abandonment worths.

I will certainly yield that it goes to least theoretically POSSIBLE that there is an IUL plan out there released 15 or 20 years ago that has actually supplied returns that are exceptional to WL or UL returns (more on this listed below), however it's essential to better recognize what an ideal contrast would entail.

These policies typically have one bar that can be evaluated the business's discernment annually either there is a cap price that defines the optimum crediting price in that certain year or there is an engagement rate that specifies what portion of any type of positive gain in the index will be passed along to the plan in that particular year.

And while I normally agree with that characterization based on the mechanics of the policy, where I disagree with IUL proponents is when they identify IUL as having remarkable go back to WL - best universal life insurance policy. Many IUL supporters take it a step further and indicate "historical" information that seems to support their insurance claims

There are IUL policies in presence that lug even more danger, and based on risk/reward concepts, those plans must have higher anticipated and actual returns. (Whether they really do is a matter for serious debate however business are utilizing this strategy to help validate higher illustrated returns.) For example, some IUL policies "double down" on the hedging approach and evaluate an extra charge on the policy every year; this charge is then used to enhance the choices budget plan; and after that in a year when there is a positive market return, the returns are amplified.

Life Insurance Tax Free Growth

Consider this: It is possible (and as a matter of fact likely) for an IUL plan that standards an attributed rate of say 6% over its very first ten years to still have an overall unfavorable rate of return during that time because of high costs. So many times, I locate that representatives or consumers that boast about the performance of their IUL plans are puzzling the attributed rate of return with a return that appropriately shows all of the plan charges also.

Next we have Manny's question. He claims, "My buddy has been pushing me to buy index life insurance coverage and to join her organization. It looks like a MLM. Is this a good concept? Do they really make just how much they say they make?" Allow me begin at the end of the inquiry.

Insurance policy sales people are not bad individuals. I made use of to sell insurance policy at the beginning of my profession. When they market a costs, it's not uncommon for the insurance coverage company to pay them 50%, 80%, also in some cases as high as 100% of your first-year costs.

It's hard to offer because you obtained ta constantly be seeking the following sale and mosting likely to locate the following individual. And particularly if you don't feel very convicted concerning things that you're doing. Hey, this is why this is the very best solution for you. It's going to be difficult to find a lot of gratification in that.

Let's chat concerning equity index annuities. These things are preferred whenever the markets are in a volatile duration. You'll have surrender periods, usually seven, 10 years, possibly even past that.

Index Universal Life Insurance Canada

Their surrender durations are significant. That's how they recognize they can take your money and go totally invested, and it will certainly be all right because you can't obtain back to your cash till, once you're right into 7, ten years in the future. That's a lengthy term. Regardless of what volatility is taking place, they're possibly going to be fine from an efficiency viewpoint.

There is no one-size-fits-all when it comes to life insurance. Obtaining your life insurance coverage strategy best takes right into account a number of elements. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, financial self-reliance can seem like an impossible objective. And retired life might not be leading of mind, due to the fact that it appears until now away.

Pension, social protection, and whatever they 'd handled to conserve. It's not that simple today. Fewer employers are using standard pension plan strategies and many firms have actually reduced or terminated their retirement and your capacity to count solely on social security is in inquiry. Even if advantages haven't been decreased by the time you retire, social safety alone was never planned to be sufficient to pay for the way of living you want and are worthy of.

Best Variable Universal Life Insurance Policy

/ wp-end-tag > As component of a sound monetary strategy, an indexed global life insurance policy can assist

you take on whatever the future brings. Prior to committing to indexed universal life insurance, right here are some pros and cons to consider. If you choose a good indexed global life insurance coverage strategy, you might see your money worth grow in value.

If you can access it beforehand, it might be beneficial to factor it right into your. Since indexed global life insurance needs a particular level of risk, insurance provider tend to keep 6. This sort of strategy also offers. It is still guaranteed, and you can change the face quantity and bikers over time7.

Commonly, the insurance policy company has a vested rate of interest in executing much better than the index11. These are all elements to be thought about when picking the finest type of life insurance coverage for you.

However, since this sort of policy is much more intricate and has an investment part, it can often come with greater costs than various other policies like entire life or term life insurance policy. If you do not believe indexed global life insurance policy is appropriate for you, below are some options to think about: Term life insurance policy is a temporary policy that typically supplies protection for 10 to 30 years.

North American Universal Life Insurance

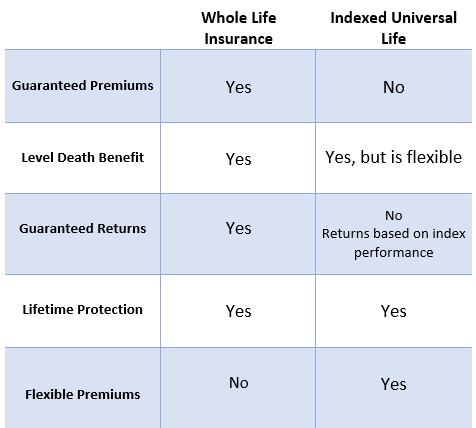

When deciding whether indexed universal life insurance policy is best for you, it's essential to think about all your alternatives. Entire life insurance policy may be a far better selection if you are seeking even more stability and uniformity. On the various other hand, term life insurance coverage might be a better fit if you just require protection for a particular time period. Indexed universal life insurance policy is a kind of plan that supplies more control and flexibility, along with higher cash value development capacity. While we do not use indexed universal life insurance policy, we can supply you with more information about entire and term life insurance policy plans. We recommend discovering all your alternatives and talking with an Aflac representative to find the best fit for you and your household.

The remainder is included in the cash value of the plan after charges are subtracted. The cash money value is credited on a month-to-month or yearly basis with rate of interest based on rises in an equity index. While IUL insurance coverage might confirm useful to some, it is very important to recognize exactly how it works before acquiring a policy.

Table of Contents

Latest Posts

Term Insurance Vs Universal Life

Signature Indexed Universal Life

Gul Policy

More

Latest Posts

Term Insurance Vs Universal Life

Signature Indexed Universal Life

Gul Policy