All Categories

Featured

Table of Contents

Below is a hypothetical contrast of historical efficiency of 401(K)/ S&P 500 and IUL. Allow's presume Mr. SP and Mr. IUL both had $100,000 to conserved at the end of 1997. Mr. SP spent his 401(K) cash in S&P 500 index funds, while Mr. IUL's money was the cash value in his IUL policy.

IUL's plan is 0 and the cap is 12%. Because his money was conserved in a life insurance coverage policy, he does not require to pay tax!

Iul Colony Counter

Life insurance policy pays a death benefit to your beneficiaries if you ought to pass away while the policy is in result. If your family members would encounter economic difficulty in the event of your death, life insurance supplies peace of mind.

It's not one of one of the most lucrative life insurance policy financial investment strategies, yet it is among one of the most secure. A type of long-term life insurance coverage, global life insurance coverage enables you to choose just how much of your costs approaches your survivor benefit and just how much goes right into the policy to gather cash money value.

Additionally, IULs allow insurance holders to get lendings versus their plan's cash money value without being taxed as revenue, though overdue equilibriums might be subject to tax obligations and fines. The key advantage of an IUL plan is its capacity for tax-deferred growth. This implies that any type of profits within the policy are not taxed until they are withdrawn.

Alternatively, an IUL plan might not be one of the most suitable cost savings prepare for some individuals, and a standard 401(k) could prove to be much more helpful. Indexed Universal Life Insurance Policy (IUL) policies offer tax-deferred development capacity, defense from market recessions, and survivor benefit for beneficiaries. They permit policyholders to gain passion based upon the performance of a securities market index while safeguarding against losses.

Indexed Universal Life Insurance Vs Roth Ira: Which One Offers Greater Tax Savings?

A 401(k) plan is a preferred retired life savings alternative that enables people to invest money pre-tax into numerous investment tools such as common funds or ETFs. Companies may also provide matching contributions, better enhancing your retirement cost savings possibility. There are two main kinds of 401(k)s: traditional and Roth. With a conventional 401(k), you can reduce your gross income for the year by contributing pre-tax dollars from your paycheck, while also gaining from tax-deferred growth and company matching payments.

Many companies additionally give coordinating contributions, effectively giving you totally free money towards your retirement. Roth 401(k)s function similarly to their conventional counterparts however with one secret distinction: taxes on contributions are paid in advance rather than upon withdrawal throughout retired life years (best iul life insurance). This implies that if you expect to be in a greater tax obligation bracket throughout retirement, adding to a Roth account could reduce tax obligations over time compared to investing entirely with conventional accounts (source)

With reduced monitoring fees typically contrasted to IULs, these kinds of accounts permit financiers to save cash over the long term while still taking advantage of tax-deferred growth potential. Additionally, numerous popular low-priced index funds are offered within these account types. Taking circulations before getting to age 59 from either an IUL policy's cash value through finances or withdrawals from a standard 401(k) plan can result in unfavorable tax effects if not managed thoroughly: While borrowing versus your policy's money worth is usually thought about tax-free as much as the amount paid in costs, any type of overdue financing balance at the time of death or plan surrender might undergo revenue taxes and fines.

What Are The Benefits Of Iul Vs. 401(k) For Retirement Planning?

A 401(k) gives pre-tax financial investments, company matching payments, and possibly more investment options. best iul insurance. Speak with a monetary planner to figure out the most effective option for your circumstance. The disadvantages of an IUL consist of greater administrative costs contrasted to traditional retirement accounts, constraints in financial investment options because of policy limitations, and prospective caps on returns during solid market efficiencies.

While IUL insurance policy may verify useful to some, it is essential to comprehend just how it functions prior to purchasing a policy. There are numerous benefits and drawbacks in contrast to other kinds of life insurance policy. Indexed universal life (IUL) insurance plan supply greater upside possible, adaptability, and tax-free gains. This sort of life insurance policy offers long-term protection as long as premiums are paid.

As the index relocates up or down, so does the rate of return on the cash money worth element of your plan. The insurance coverage company that provides the policy may offer a minimum guaranteed rate of return.

Financial professionals frequently advise living insurance policy protection that amounts 10 to 15 times your annual earnings. There are several downsides related to IUL insurance plans that doubters are fast to mention. As an example, somebody that establishes the policy over a time when the market is choking up could end up with high premium payments that do not contribute at all to the money worth.

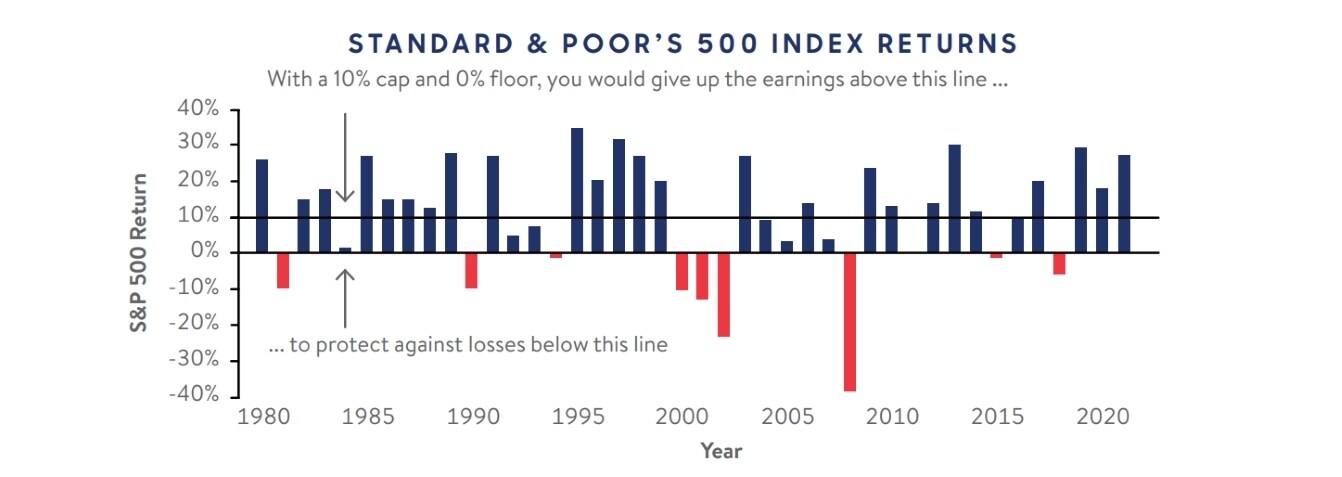

Apart from that, remember the following other factors to consider: Insurance provider can set involvement prices for how much of the index return you obtain each year. Allow's claim the policy has a 70% involvement rate. If the index expands by 10%, your money value return would be just 7% (10% x 70%)

On top of that, returns on equity indexes are often capped at an optimum quantity. A plan could state your maximum return is 10% each year, regardless of how well the index carries out. These restrictions can limit the real rate of return that's credited towards your account each year, no matter of exactly how well the plan's hidden index performs.

Why Choose Iul Over A 401(k) For Retirement?

However it's crucial to consider your personal threat resistance and financial investment goals to make certain that either one lines up with your overall technique. Whole life insurance coverage plans usually include an ensured rates of interest with predictable premium amounts throughout the life of the policy. IUL plans, on the various other hand, deal returns based on an index and have variable premiums in time.

There are numerous various other sorts of life insurance coverage policies, described below. provides a set advantage if the insurance holder dies within a set duration of time, generally in between 10 and 30 years. This is among one of the most inexpensive sorts of life insurance policy, as well as the most basic, though there's no money value buildup.

Transamerica Corporation Iul

The policy gets value according to a dealt with timetable, and there are less charges than an IUL plan. A variable policy's cash money value might depend on the performance of certain stocks or various other safeties, and your costs can likewise change.

Table of Contents

Latest Posts

Term Insurance Vs Universal Life

Signature Indexed Universal Life

Gul Policy

More

Latest Posts

Term Insurance Vs Universal Life

Signature Indexed Universal Life

Gul Policy